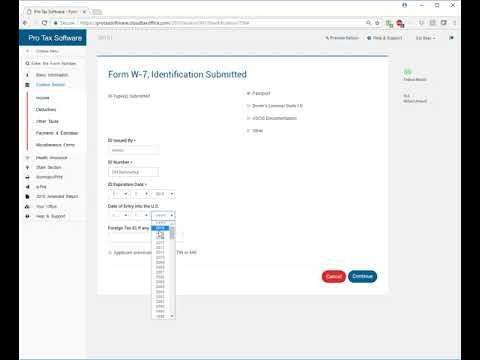

In this video, we're going to be filing a tax return and filling out a W7 form for a first-time filer that does not already have an ITIN number. So, the first thing we're going to do is start the new return. We're not using a template, so we're just going to put in the social security number as all zeros. This is because we will see why later on. I'm going to use this tax return sample for another return and mark it as head of household. When we get to the primary taxpayer information page, it says that this return contains a W7 application. If the taxpayer does not need to apply for an ITIN, you can click here to skip it. So, I'm going to put in the taxpayer's information. I'm going to call this return "RI 10 file a return". I'll put in the date of birth as 9/9/1981, and the occupation is sales. Now, I'll enter the address as 111 East Boulevard, Florida, 305 blah blah blah. We'll click continue and move on to entering some dependent information. This is also going to be an 18 ITIN file for a dependent. The last name is "Pullovers" (I spelled it wrong on the other page, but it doesn't matter). The social security number is non-existent because I'm going to check the option that says the dependent does not have an SSN or ITIN. Now, let's go back and check the social security number information. I left it empty initially, but when I started to enter it and hit enter or tabbed out of it, there's an option that says if the dependent does not have an SSN or ITIN. I'm going to click on that because this dependent will be completing form W7. The relationship is...

Award-winning PDF software

Www.irs.gov w-7 (sp) Form: What You Should Know

Form W-7 (COA), certificate of accuracy for IRS individual taxpayer identity number (ITIN) (COA), 5656, or the original. If the application contains additional proof of identity or an ITIN, include that. When submitting only a copy of an ITIN, be sure not to include an ITIN number. 2. U.S. federal tax return or federal return transcript. 3. Current tax certificate (IRS Form 1099-INT). 4. Form W-8BEN. 5. Copy of foreign bank statement or foreign bank statement and pay stub or wire authorization. 6. U.S. military identification card or DD-214, unless the Form W-7 was issued after January 27, 2005. 7. Your social security card, if issued after May 21, 2009. 8. Copy of the applicant's non-U.S. birth certificate, or a copy of a U.S. birth certificate that has been certified. 9. Copies of any document, paper, or other information that the IRS requires to complete your application. Instructions for Form W-7 (COA) or Form W-8BEN — IRS Form W-7 application (SP); Form W-8BEN form (COA) — IRS Form W-7 and instructions. The application form is attached to this form. The instructions are on pages 3 to 7. Use the form to complete the form and send to the IRS. Form W-8BEN, Application for IRS Individual Taxpayer Identification Number. Use Form W-8BEN as an alternative to use the application form. The form can be used to apply for the IRS ITIN. A. U.S. federal tax return or tax return transcript. 1. U.S. federal tax certificate (IRS Form 1099-INT), current W-8BEN or W-8ECI; 2. Pay stub or wire authorization, provided the pay stub or wire authorization was obtained without being used or in the case of W-8BEN, a copy of the pay stub or wire authorization. 3. Copy of applicant's U.S. birth certificate, or a copy of a U.S. birth certificate that has been certified. 4. Copy of foreign bank statement or foreign bank statement and pay stub or wire authorization. 5. Copy of applicant's non-U.S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-7, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-7 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-7 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-7 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Www.irs.gov form w-7 (sp)