Hi everyone this is ruling and hereto help you out how to fill out thei-765 application for employment authorization, so you need to go to google and type ini-765, and you will see it is linked on high seven six five applications for employment authorization then click this line then you will see the official website of USCIS, so you need to download the form i-765 and also the instructions for form i-765 because you need the instruction for question number 16 inform i-765 so once you download thei-765 go ready to fill out forms so i-765 application for employment authorization okay, so I am applying for a job with a company called Watson'’s or Watson'’s and Camp;#39’m filling out the application on my computer okay, so the first question is what is your full name if you wanted to use your married name then you need to put the family name the last name of your husband your first name and your middle name when you apply for a OS whatever means you put, or you write on your full name it should be the same on this form okay so if you want to use your single name stamp;#39’s fine if you want to use your maddening stamp;#39’s fine stamp;#39;your own choice, so I wanted to use my married name and then my middle name would be Mike my last name when I am single because for example my full name when I am single is frozen in baggage Ohio the now I am married my phone name would be roasting nickel Canada;#39’t bail Always explain that first most of the questions is what is the middle name that they will put where they remarried, so I want to confirm that but to clarify a question so your...

Award-winning PDF software

How to prepare Form W-7

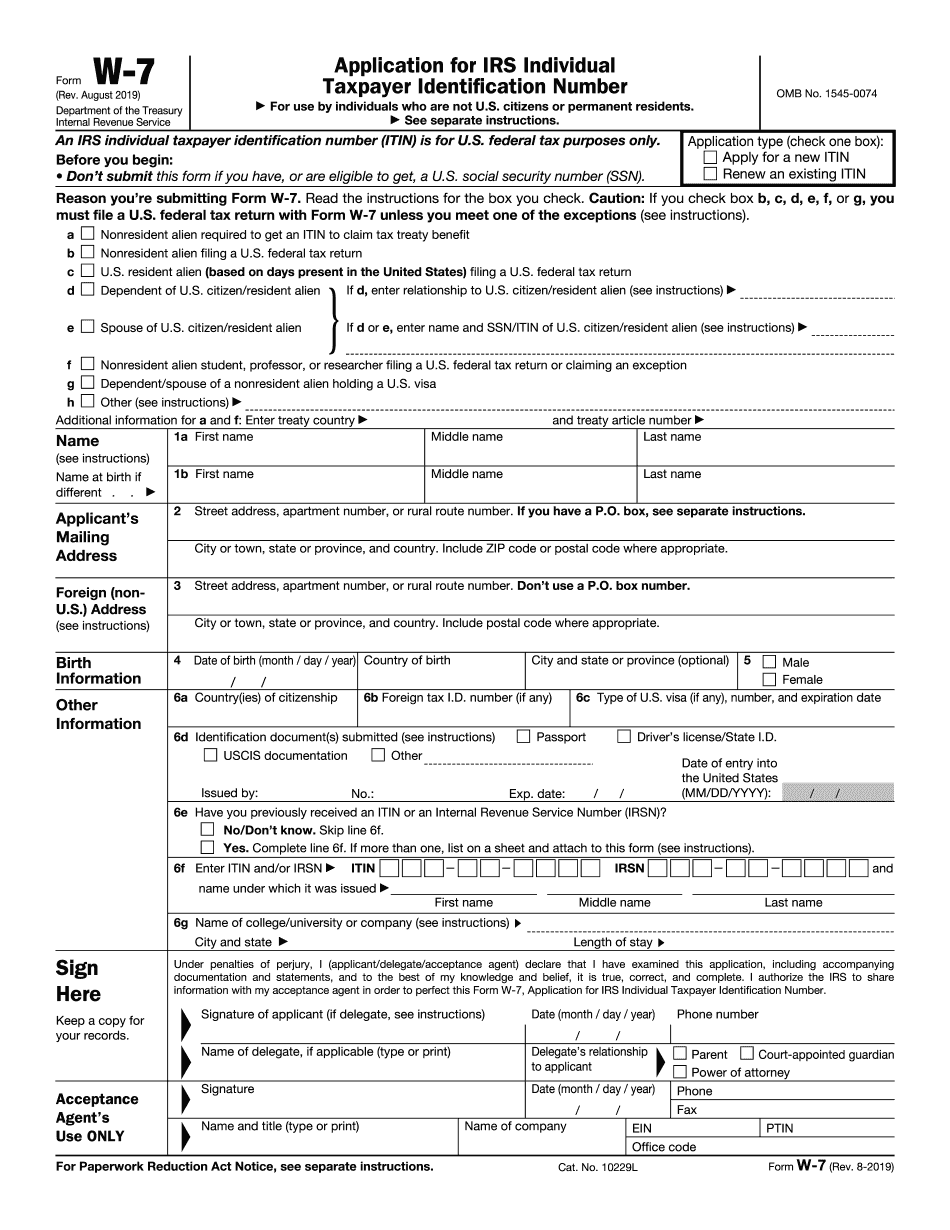

About Form W-7

Form W-7 is an Application for IRS Individual Taxpayer Identification Number. This form is mainly used by individuals who are not eligible to obtain a Social Security number but need to file a tax return or perform transactions that require a taxpayer identification number in the United States. Some examples of who may need to fill out Form W-7 include foreign nationals who have taxable income in the US, dependents or spouses of US citizens or residents who do not qualify for a Social Security number, and nonresident aliens who receive income from US sources. The form requires personal identification and supporting documents, such as a passport or birth certificate, to be submitted to the IRS.

What Is W7 Form?

Online technologies allow you to arrange your document management and improve the productiveness of the workflow. Observe the short manual in an effort to fill out Irs W7 Form?, stay clear of mistakes and furnish it in a timely way:

How to fill out a W7?

-

On the website containing the document, press Start Now and move for the editor.

-

Use the clues to fill out the applicable fields.

-

Include your individual data and contact data.

-

Make sure you enter proper information and numbers in suitable fields.

-

Carefully verify the data of the blank as well as grammar and spelling.

-

Refer to Help section when you have any issues or address our Support staff.

-

Put an digital signature on your W7 Form? Printable using the assistance of Sign Tool.

-

Once blank is finished, press Done.

-

Distribute the ready form by using email or fax, print it out or save on your device.

PDF editor enables you to make improvements on your W7 Form? Fill Online from any internet connected gadget, personalize it based on your requirements, sign it electronically and distribute in several means.

What people say about us

The expanding need for electronic forms

Video instructions and help with filling out and completing Form W-7