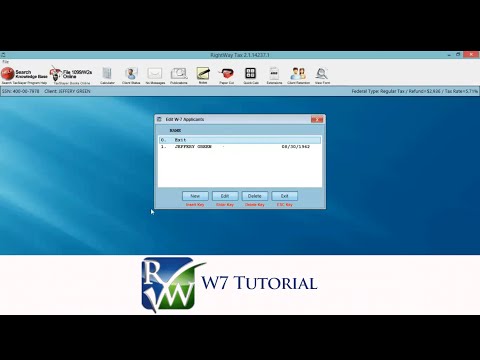

What we're gonna cover in this video real quick is the form W7. - The W7 is the federal form for securing an individual tax identification number (ITIN) for non-citizens earning money in the country and paying taxes on it. - The ITIN is only valid for five years and needs to be reapplied for after expiration. - It is commonly done in tax businesses nowadays and it is recommended to brush up on it as a useful skill. - To access the W7 form, use the form finder and type in W7. - Click on the form that pops up. - Enter the number of the applicant and add any dependents if necessary. - Select the dependent as the W7 applicant and proceed. - The W7 form is easy to fill out, following steps one through 16 provided on the form. - Prior reasons for filing the form are already provided. - Fill in personal information such as legal name, foreign address, country of citizenship, foreign tax ID (if applicable), and identification number (such as a passport). - Click exit and fill out if you are a student. - Completing the W7 form is straightforward, but commonly asked about. - This video provides a quick guide on locating and completing the form.

Award-winning PDF software

W7 fill in Form: What You Should Know

S. Or foreign passport) because they would face economic hardship should they lose their current United States resident status. In the case of a citizen (alien) who is an eligible legal resident, the person's ITIN would be applicable U.S. tax and social security payments would be based on that resident's residency to the same extent as a U.S. citizen. A U.S. citizen may receive Social cards as permanent resident aliens even A U.S. or foreign passport. Form W-7, or Form W-7A, can be completed using computer software such as e-File Online or a paper Forms may also be completed using a computer-printed page with a signature machine or fax machine. A paper Form W-7 will be accepted as long as the required information is provided on the form. The current regulations that govern ITIN's For the most part, Form W-7 applies only to non-citizens. Form W-7 is a paper application where the applicant must provide his or her identification information with the required information in the correct format, along with any required payment of taxes and child support. However, most countries require that non-U.S. citizens provide their Social Security number but not their other information. What to do with Form W-7: IRS Form W-7 The IRS requires W-7 returns to be filed by the due date or the next calendar month unless the IRS provides additional information. If you miss the deadline, you must make the required tax payments and child support in advance of the due date by electronic transfer or by mail. If the IRS's request for additional information was not filed or if the IRS has determined that you are not required to make the tax payments and child support, they can revoke your W-7. How to file Form W-7: IRS Form W-7 (Rev. Aug 2019) Use Form W-7 to file Form 3911XW, Request for Taxpayer Identification Number, to obtain an individual taxpayer identification number (ITIN) for you, your spouse, or your dependent children. You may be an alien, a lawful permanent resident, a non-citizen citizen, or a U.S. dependent child.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-7, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-7 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-7 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-7 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W7 fill in